Summary

- Investor sentiment remains strong for PPD, as shareholders have enjoyed almost 250% upside since the selloff in March.

- The stock has bounced away from support 7 times since then, in a narrow ascending channel with low downside, although valuation remains low with an -86% value gap.

- Relative strength has been strong too, and shares remain out of overbought territory, in spite of the strong uptrend.

- Recent upgrade in guidance from management in the ranges of +10%-12% in revenues and EBITDA adds weight to this bullish sentiment.

- A strong Q3 earnings with an earnings surprise may drive price up in the short term, where the fundamental outlook would provide support at these new levels.

Pharmaceutical Product Development, or PPD Inc. (NASDAQ:PPD), continues its steady climb north over this year, with shareholders enjoying +246.18% in returns since the selloff in march. PPD is a relatively small large-cap by definition ($12.8 billion market capitalization) but revenues have been solid this year since their IPO completion back in February. PPD was previously listed back in 1996, but was acquired back in 2011 and remained private until this year.

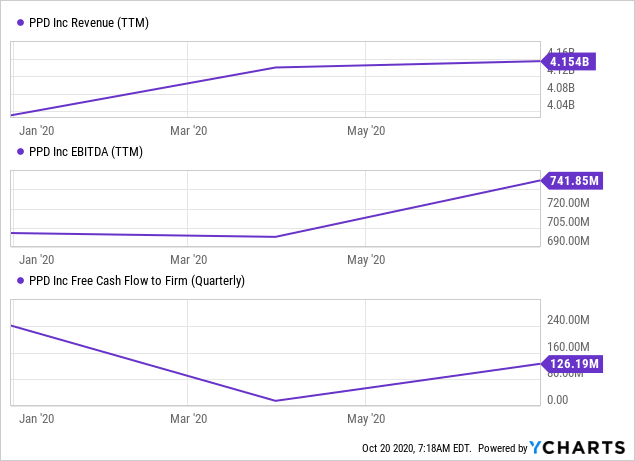

Since re-listing, the company has enjoyed top line earnings of $4.1 billion, EBITDA of $702.8 million and FCF just shy of $300 million from the last earnings report. All figures are using TTM adjustments. Earnings surprises over the last 2 reports have helped prop up the share price at the exit of each quarter, and we are hoping for additional support with an earnings beat for Q3 2020. Empirical evidence demonstrates the short-term correlation between earnings surprises and upticks and price, which we will be drawing on for the next play with PPD.

Data by YCharts

Data by YChartsPPD has given good insights into the potential for ongoing revenue generation, with low ROIC of around 3% but high ROCE of 13.05%, which will help in explaining the valuation. We've observed these figures alongside decent return over the asset base of 5.5%, with the company also turning over $0.74 for every dollar invested into the asset base. From these measures, management have done a sound job in facilitating the market sentiment for the run-up in price this year, alongside signaling future growth for the company over this time.