Summary

- Syneos Health Inc. is a 22-year-old global biopharmaceutical solutions organization offering a full suite of clinical and commercial services.

- Syneos's competitive advantages are its unique operating model, exceptional experience/track record, and strong industry relationships.

- Syneos's CRO revenue (73% of total) is in an industry with an expected CAGR of 6.8% and its CCO revenue (27%) within an industry with a 5.5% CAGR.

- Syneos's "ForwardBound" margin enhancement program targeting a 13-14% year-end EBITDA margin brings the fiscal year-end EBITDA expectations to $587M (+1% y/y).

- In summary, due to strong industry growth, improving balance sheet, widening margins, and a strong COVID-19 response, Syneos is a "buy" with an FYE price target of $63 (10% upside).

Source: Syneos Health Inc.

Introduction: what is Syneos Health?

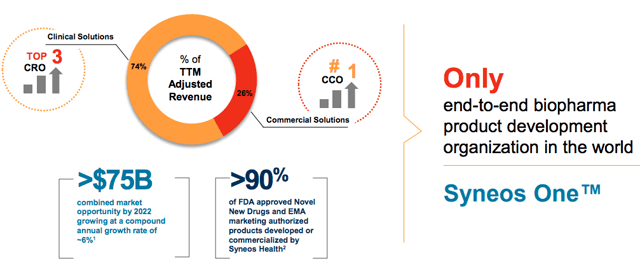

Syneos Health Inc. (NASDAQ:SYNH) is a global biopharmaceutical solutions organization offering a full suite of clinical and commercial services targeting the biotechnology, biopharmaceutical, and medical device industries. Founded in 1998 and headquartered in North Carolina, Syneos operates two broad segments: Clinical Solutions - CRO (73% of revenues), and Commercial Solutions - CCO (27%), which together cover phase 1 through to full commercialization. Syneos value-add is in increasing the chance of regulatory approval and commercial success globally in a rapidly evolving industry.

Graphic Source: Syneos - Jefferies Virtual Healthcare Conference

Business Strategy in 2020: Syneos Health has undertaken an aggressive margin enhancement program for FY2020-2021 focused on achieving a 13-14% EBITDA margin by FYE 2020 (Q1 20':10.4%). This is achieved through top-down salary reductions and voluntary/involuntary layoffs of unnecessary positions in their 24K employee pool, amongst other strategies. Additionally, the company is targeting a variety of growth opportunities outlined below in the "Strategy Section" based in part around acquisitions of deep-tech organizations augmenting organic growth.

Investment thesis: Syneos operates in a growing industry with a 5-8% medium-term industry CAGR and possesses strong fundamentals enhanced by the company pursuing EBITDA margin improvements of 2-4% unlocking $75M-$100M of run rate savings by FYE 2021. The 2020 forecasts show strained growth prospects, but the margin enhancement and larger-than-average stock-buyback program retain investor value. Following 2Q 2020's guidance, it becomes clear that operational improvements are key for stock appreciation and enable the company to exceed revenue and margin expectations set out for 2H 2020. This leads the investment thesis for Syneos Health in 2020 to be a "buy" contingent on quarter/quarter margin enhancements. The author expects that Syneos's 2020 FYE target stock price is $63 (10% upside).

Competitive advantages: strong, but facing increasing pressures due to consolidation

Syneos's competitive advantages can be broken down into 3-key areas: 1) unique operating model, 2) exceptional experience/track record, and 3) industry relationships.

[img src="https://static.seekingalpha.com/uploads/2020/7/1/49380510-15936128749097352.png" alt="Syneos One™ Syneos One is the most powerful expression of our Biopharmaceutical Acceleration Model BAM). A fully integrated, insights-driven product development methodology. This proprietary methodology provides a unique combination of asset strategy and execution to maximize value from early concept through to commercialization." width="640" height="253" data-width="640" data-height="253" data-og-image-twitter_small_card="true" data-og-image-twitter_large_card="true" data-og-image-twitter_image_post="true" data-og-image-msn="true" data-og-image-facebook="false" data-og-image-google_news="true" data-og-image-google_plus="false" data-og-image-linkdin="true" style="display: block; float: none; margin: 0px;">Graphic Source: Syneos Health Inc.

Syneos is a functional service provider filling the gap other niche services cannot due to their full-suite offering termed Syneos One. Due to their full-suite offering and more than two decades of operating history, they can harness the data collected from various clients and provide "asset customized" insights. Their experience in global management comes from both sides of biopharmaceutical outsourcing and therapeutic research. Their relationships stem from a diversified customer base spanning big pharma to SMID, small-mid-sized companies. In the clinical sphere, Syneos has developed longstanding relationships with principal investigators and clinical research sites, enabling them to create needed consistency for expensive clinical operations.