Summary

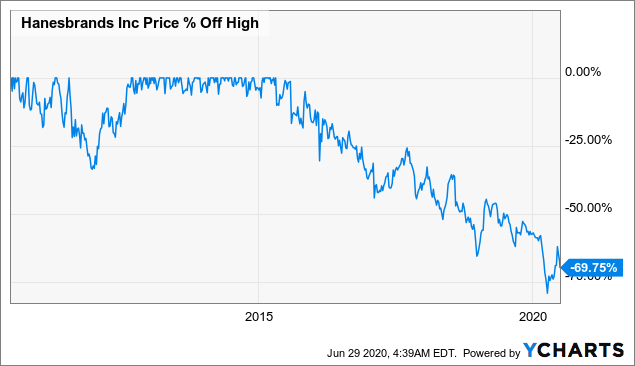

- Hanesbrands has long been on my watch list. The share price is now almost 70 percent off its high.

- The dividend and the fair value model also indicate a strong undervaluation.

- Nevertheless, I am waiting with an investment. In my opinion, the medium-term downside risk predominates. A dividend cut is not unlikely.

Introduction

Hanesbrands (HBI) has been on my extended watch list for a very long time. Especially the relatively low dividend payout ratio and the favorable valuation have aroused my interest several times. And even now, the company continues to attract investors with a single-digit P/E ratio and a dividend yield of almost 6 percent. In the end, however, I am happy not to have invested. Honestly, the company has done nothing for you during the past ten years despite paying a decent amount of dividends. The dividends are far from enough to plug the hole in your portfolio that the stock ripped.

Data by YCharts

Data by YChartsIndeed, the company is still in a price range it has not been in for over seven years. But I still think that in the medium term, the downside scenario will predominate. I also believe that the dividend is seriously threatened.

Fair valuation model indicates substantial undervaluation

There are reasons why the company was so cheap, even before COVID-19. Firstly, there is strong competition for Hanesbrands. The company does not operate in a market where it has a strong moat, although its brands are well known, especially in the US market. The company is somewhat dependent on individual commercial customers such as Walmart (WMT) and Target (TGT), as it does not sell its products directly to customers.

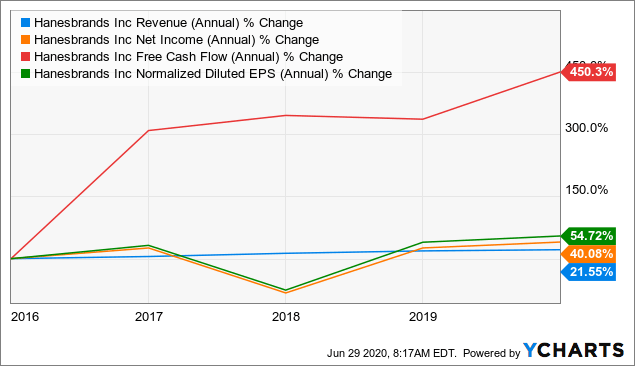

Secondly, Hanesbrands has tried to grow with expensive expansion and acquisitions. The reason for this was that the company had severe problems with organic growth. With these measures, the company has paid dearly for growth.

Data by YCharts

Data by YChartsThe result was an extremely leveraged balance sheet and a correspondingly high debt ratio.