The Paycheck Protection Program (PPP) is the largest fixture of federal coronavirus financial relief programs, providing forgivable loans to small businesses with fewer than 500 employees to cover payroll and associated costs. The initial $349 billion in PPP funding was exhausted in just two weeks, and was disproportionately allocated to more small businesses in some parts of the country than others, so an additional $310 billion was apportioned to the program.

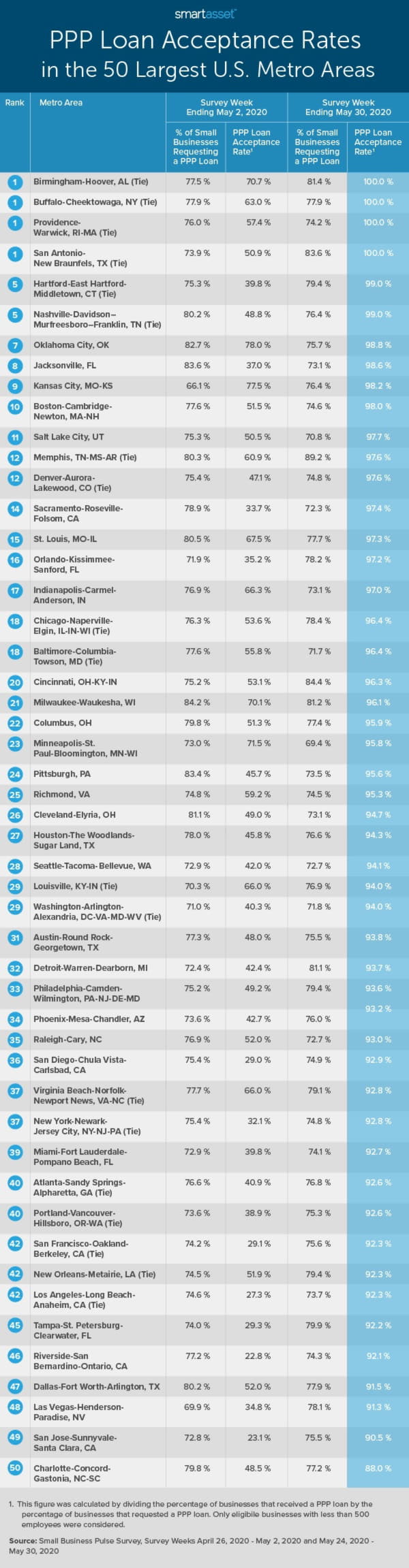

To see how PPP loan acceptance rates have changed in the 50 largest U.S. metro areas over time, SmartAsset analyzed data from the Census Bureau’s new Small Business Pulse Survey. While PPP loan funding is catching up to demand in the second round of funding in all major metros nationwide, acceptance rates are higher in some areas than others.

- The Raleigh-Cary and Charlotte-Concord-Gastonia metro areas both rank in the bottom half of the study for their PPP loan acceptance rates, based on survey data for the week ending May 30, 2020.

- The Raleigh area ranks 35th out of the 50 largest metro areas for its acceptance rate of 93.0%. Charlotte has the lowest acceptance rate of 88%, making it the only metro to report an acceptance rate of less than 90%.

- To see how all 50 big metro areas stack up, check out the table below.