Summary

- Bank of America stock is recovering from the COVID-19 lows of March 2020.

- The current earnings are hurting from (temporary) credit provisions.

- Current valuation levels are on the low side.

- The low implied volatility creates opportunities with a strong risk-reward profile.

Investment thesis

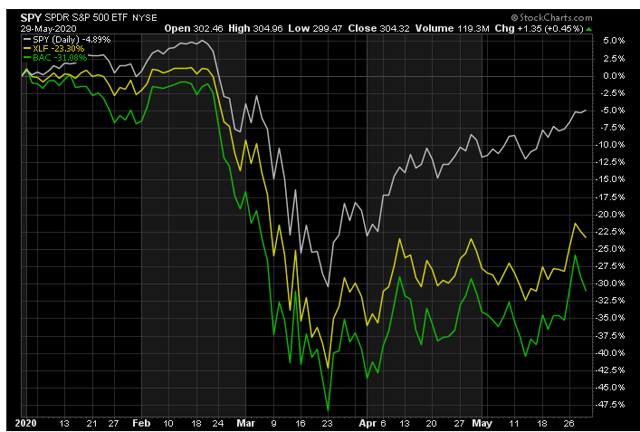

The stock market has been strongly impacted by the coronavirus, which triggered a selling wave in all equities. Large banking corporations, like Bank of America (BAC) or Wells Fargo (WFC), have seen their equity values decline by 50%, whereas the stock market in general stopped the decline at 30%. A number of equities have started a V-shape recovery, whereas the major banks are still recovering from their recent 52-week low levels.

Bank of America's business model is negatively impacted by the lower interest rates and the increase of the credit provisions, as a consequence of the COVID-19 virus. This has pushed the current valuation of the bank to an all-time low level, which is not in line with the long-term intrinsic value.

We expect the stock price of BAC to retrieve to its previous high levels of $33 and will present an investment idea which investors and traders can use to benefit from this potential pullback.

Price Performance during the COVID-19 correction

Bank of America stock price corrected by 50% during March 2020 as the coronavirus caused a selling spree in the stock market. The stock price went as low as $17.95, a level we had not seen in the last 3 years (since November 2016).

After this new multi-year low-level was reached on March 23, 2020, investors gained their trust again in the stock market and equity prices started to rebound. BAC followed the rise in the broader stock market but lagged behind.

At the moment of writing this article, the S&P 500 (SPY) is still 10% away from its previous 52-week high level, whereas BAC is still 33% below its top level. The same can be said for the financial sector (XLF), but even here BAC is underperforming.

(Source: StockCharts.com)

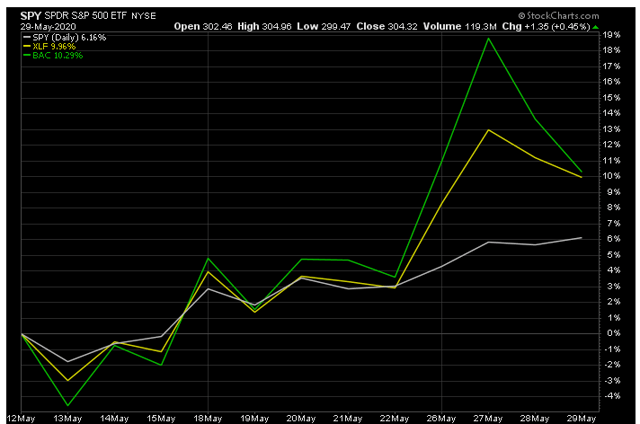

When we look at its performance during the second half of the previous month, we can see Bank of America is starting to catch up with the stock market in general.

(Source: StockCharts.com)

The stock price rose strongly on May 26 and 27 with above-average volume. While there still is a long way to go, it seems investors and large funds are purchasing bank stocks again in their portfolio.