Summary

- Honeywell's stock is down big so far in 2020.

- However, the company still has promising long-term business prospects. It also helps the bull case that Honeywell entered 2020 in a great position, operationally and financially.

- I hold a position in Honeywell, and I plan to add shares on any significant pullbacks.

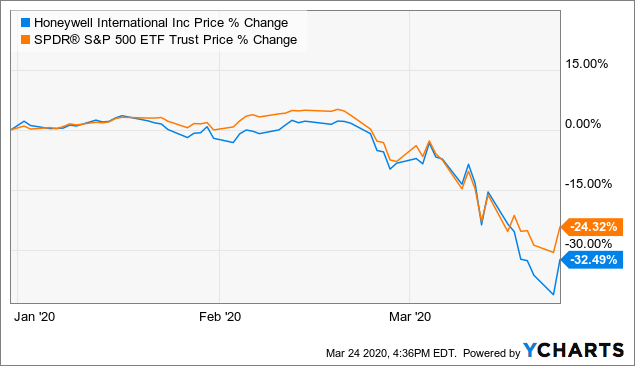

Honeywell's (HON) stock has taken a significant hit so far in 2020 due mainly to COVID-19 concerns (and the potential impact to the economy). On a year-to-date basis, the stock is down ~32% and it is underperforming the broader market by almost 10 percentage points.

Data by YCharts

Data by YChartsInvestors should definitely be concerned about the potential economic impact of the current health scare but, in my opinion, this pullback will eventually turn out to be a great long-term buying opportunity. To this point, I believe that shareholders of this diversified, well-capitalized industrial conglomerate should use the current dip as an opportunity to add to their HON positions.

The Concerns Are Valid

It would be a huge understatement to say that the industrial sector has felt the pain of the COVID-19 fallout.

Source: Fidelity

Additionally, it's important to note that U.S. economic activity is predicted to fall off of a cliff in the first half of the current year.