Summary

- BAC stock has oscillated with volatility in the last year but is quietly hitting yearly highs.

- We believe lower rates have made an impact already, as evidenced by the recent Q3 report.

- There are several metrics you absolutely must focus on.

- We like the stock long term and give our early 2020 projections for top and bottom line performance.

- Looking for a helping hand in the market? Members of BAD BEAT Investing get exclusive ideas and guidance to navigate any climate. Get started today »

Bank of America (BAC) was a top pick in the financial sector for us for the year 2018. As the year came to a close, we turned a bit bearish, only to watch the stock fade hard to start 2019. It has spent all of 2019 trying to recover ground. As investors, we cannot have this. We simply cannot. As traders, we love it, because we can leverage the swings long and short. While it is undeniable that the company has turned it around compared to say 5 years ago, it has been a tough investment to make lately. We have some concerns with rate changes (that is, cuts) that could eat into net interest income as we enter 2020. That said, BAC has always delivered responsible growth and we remain long-term bullish on the stock. To be clear, we certainly believe that a trader's upside is limited right now, so you should wait for a pullback. Long term, it is a bank we want to own, especially if we can get a fair price. Let us discuss some of the critical metrics that you must be aware of to consider investing here. And when we say 'you must,' these are metrics you should watch every quarter, as they can impact the trading of the stock near term, but give you a possible outlook in the medium term for performance.

Recent trading

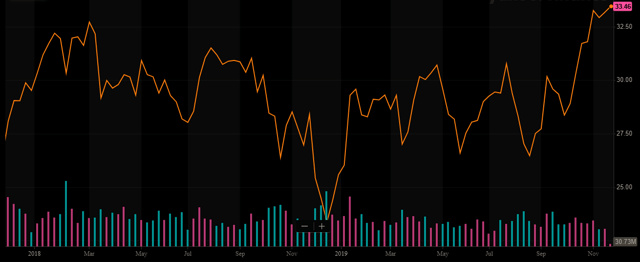

Bank of America has delivered slow and steady growth in every area of the company's operations. It is not without hiccups, but when we look back this statement is undeniable in the medium to longer-term retrospective view. The stock has been pummeled and rebounded, then pummeled again, only to hit 52-week highs:

Source: BAD BEAT Investing

But what about as we look ahead. A retrospective view of trading is informative, but prospectively, it comes down to performance, and expectations. Tailwinds came in the form of the Federal Reserve and its activity to raise interest rates in the past, no, these rates are falling. In general, falling rates hurt. That said, markets are very volatile, and banks usually take a hit when there is the possibility of any rate change. We saw this a bit this year. Now, the bank has adjusted, but we enter 2020 soon, which is sure to be volatile, without a significant pullback since December 2018. We think BAC has to be on your watchlist. Why?

Let it pull back

We love the company and want to own the stock. But let us be smart traders. The stock is ahead of itself after a big rally, and profit taking is likely on any poor news. General market malaise could be good for 10%. We want to buy at or around $30, ideally. Although the Street is concerned with the impacts of a trade war and currency fluctuations, this is a short-term problem. Volatile rates truly are a problem for the major financials, and frankly, lower rates pressure income potential. Have lower rates had an impact already? We believe so, as evidenced by the recent Q3 report, but it is the coming quarters that have us further concerned as recent cut just occurred again, and some believe another cut is possible within a month. What does the data tell us? Well, you must be aware of the trends.