Summary

BAC tends to overreact to bad market conditions and is currently trading well below its excess returns valuation.

I find BAC to be undervalued to the tune of 10%.

I offer an options trade on BAC's undervaluation.

Looking for a community to discuss ideas with? Exposing Earnings features a chat room of like-minded investors sharing investing ideas and strategies. Get started today »

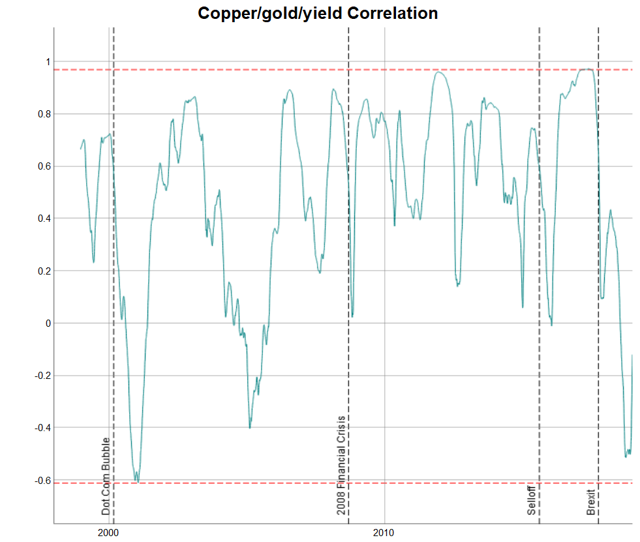

In October, I wrote that the risk of a recession is rising. One of my market crash prediction indicators was showing an extreme signal. This has since reversed:

(Source: Damon Verial; data from Quandl)

The copper/gold/yield correlation was strongly negative for an intermittent period but is now normalizing. A fall in this correlation is often necessary but not sufficient for a bear market. However, it seems my concern was overdone, and copper/gold is no longer in direct divergence with the yield rate: