Bank of America (NYSE:BAC) shares have been penalized over recent months by fear of a flattening yield curve and by trade war worries. However, the company reports earnings Monday July 16 that should reflect a positive current economic reality in America and for the bank as well. Given the shares' attractive valuation, my expectations for strong earnings this quarter, and my positive economic outlook for the next two years, I believe BAC shares should be poised for a short-term burst higher and certainly further long-term appreciation. My price target is $41 by year-end, excluding the stock's 1.65% dividend yield, and I see a margin of safety worst-case value of $33, based on my analysis of forward earnings expectations and my expectations of likely valuation at year-end, even given the possibility of continued trade policy uncertainty.

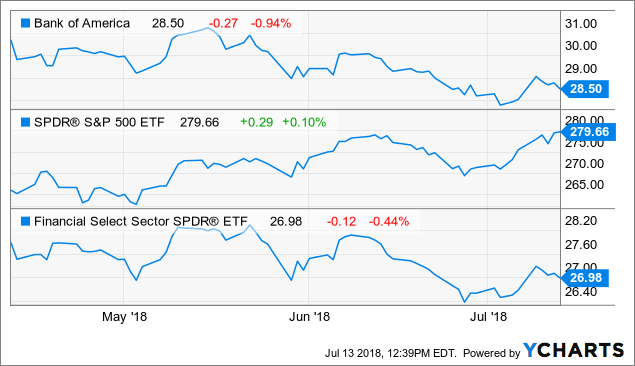

BAC data by YCharts

BAC data by YChartsBank of America Shares are on Sale

Bank of America shares have suffered on a relative basis over the last several months. BAC shares were down 10.4% from March 15 through July 12 of this year, versus the 1.6% gain in the SPDR S&P 500 (SPY) and the 6.4% decline in the Financial Select Sector SPDR (XLF). Still, we should note that BAC shares have about mirrored the performance of the S&P 500 Index over the last 52 weeks, with BAC up 14.3% versus the 14.3% appreciation in the SPY ETF.